Revealed: Ferrari’s $2 Billion Sponsorship Haul

Ferrari lost yesterday's Austrian Grand Prix but it leads the way when it comes to sponsorship income (Josef Bollwein/SEPA. Media /Getty Images)

GETTY IMAGES

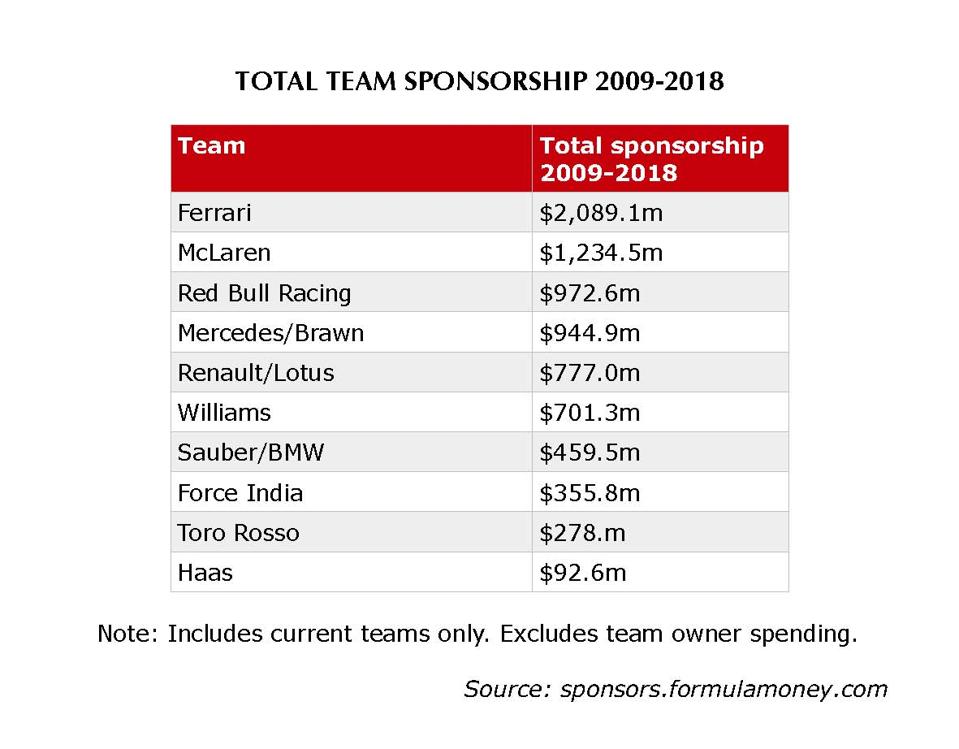

Ferrari has taken the title of having the highest sponsorship income of any team in Formula One auto racing over the past decade with a total of $2.1 billion despite not winning the championship during that time.

The famous Italian team has finished second in the standings for the past two years running and currently lies in that spot after its driver Charles Leclerc was pipped to the post by Red Bull Racing’s Max Verstappen at yesterday’s Austrian Grand Prix.

Ferrari is the only team which has been continuously competing since the F1 championship launched in 1950 and it has won more titles than any of its rivals. Accordingly it is natural that it has a turbocharged sponsorship haul. However, you might also expect that this would have been dented by its run of bad luck. In fact, as the table below shows, it is in pole position on the ranking of F1’s richest teams by a long way.

Ferrari is in pole position on the ranking of F1's richest teams

SPONSORS.FORMULAMONEY.COM

Research has revealed that Ferrari’s sponsorship balance peaked at $249.5 million in 2010 which was the biggest annual total for any F1 team during ten years to the end of 2018. It was fueled by a new deal with Spanish bank Santander, worth an estimated $50 million annually, with a further $100 million coming from tobacco giant Philip Morris. Although this has since reduced to around $50 million, it is still partnering with the team despite tough restrictions on advertising for tobacco manufacturers.

History and mystique aren’t the only driving forces behind sponsors signing up with Ferrari. Even though it hasn’t won the title since 2008, it has been at the sharp end of the grid having won at least one race in eight out of the past ten years. This consistent success has attracted loyal brands with its sponsorship from oil giant Shell alone dating back to the 1920s as we have reported.

Ferrari’s sponsorship tally is 69.2% higher than its closest rival McLaren, which has also fallen on hard times in recent years. Unlike Ferrari, which has been consistently outclassed by its rivals Red Bull Racing and Mercedes, McLaren began misfiring in 2014 when F1 changed its engine from a 2.4-liter V8 to a 1.6-liter V6. However, McLaren is still F1’s second most-successful team with 20 drivers’ and teams’ titles compared to the 31 won by Ferrari.

This success made McLaren one of the most sought-after F1 teams and its sponsorship portfolio was crowned by a title partnership with telecoms giant Vodafone which was paying an estimated $75 million at its peak. It helped to drive total sponsorship income of around $184.9 million to the team in 2009 but by 2018 it had reversed to $57.9 million which , as we have reported, is still a high-octane effort given its performance and the challenges facing the market in general.

The data excludes spending by team owners and only covers outfits which are running in 2019 so America’s Haas F1 languishes at the bottom of the list as it has only been competing for three seasons.

This author has unique insight into the value of F1 sponsorship through leading a team which has been analyzing the deals for 15 years. Fees for every sponsorship deal since 2004 have been derived from hundreds of interviews cross-referenced with thousands of company filings. Values are based on the size, location and number of decals as well as other benefits received by the sponsor and the performance of the team at the time the deal was signed.

The results have been compiled in the new Formula Money Sponsorship Database (sponsors.formulamoney.com), the first-ever searchable database of F1 sponsorship values. The database not only covers every team sponsorship deal since 2004 but also all of the series partnerships, race title sponsorships, trackside advertising, and team owner spending during that time. All together it covers more than 6,000 deals from 1,066 companies which paid a total of $30 billion. Ferrari’s sponsorship tally alone comes to 7% of the total and this again shows why the Italian team holds the keys in F1.

It’s a game of inches — and dollars. Get the latest sports news and analysis of valuations, signings and hirings, once a week in your inbox, from the Forbes SportsMoney Playbook newsletter. Sign up here.